A pause in the growth trend indicates an opportunity for distressed consumers to take action.

(Washington, D.C.) — As inflation rates remain stubbornly high and consumer debt delinquencies show an increase across all debt types, the NFCC Financial Stress ForecastSM indicates that American families continue to experience increased financial pressures at levels significantly higher than any time during the past three years.

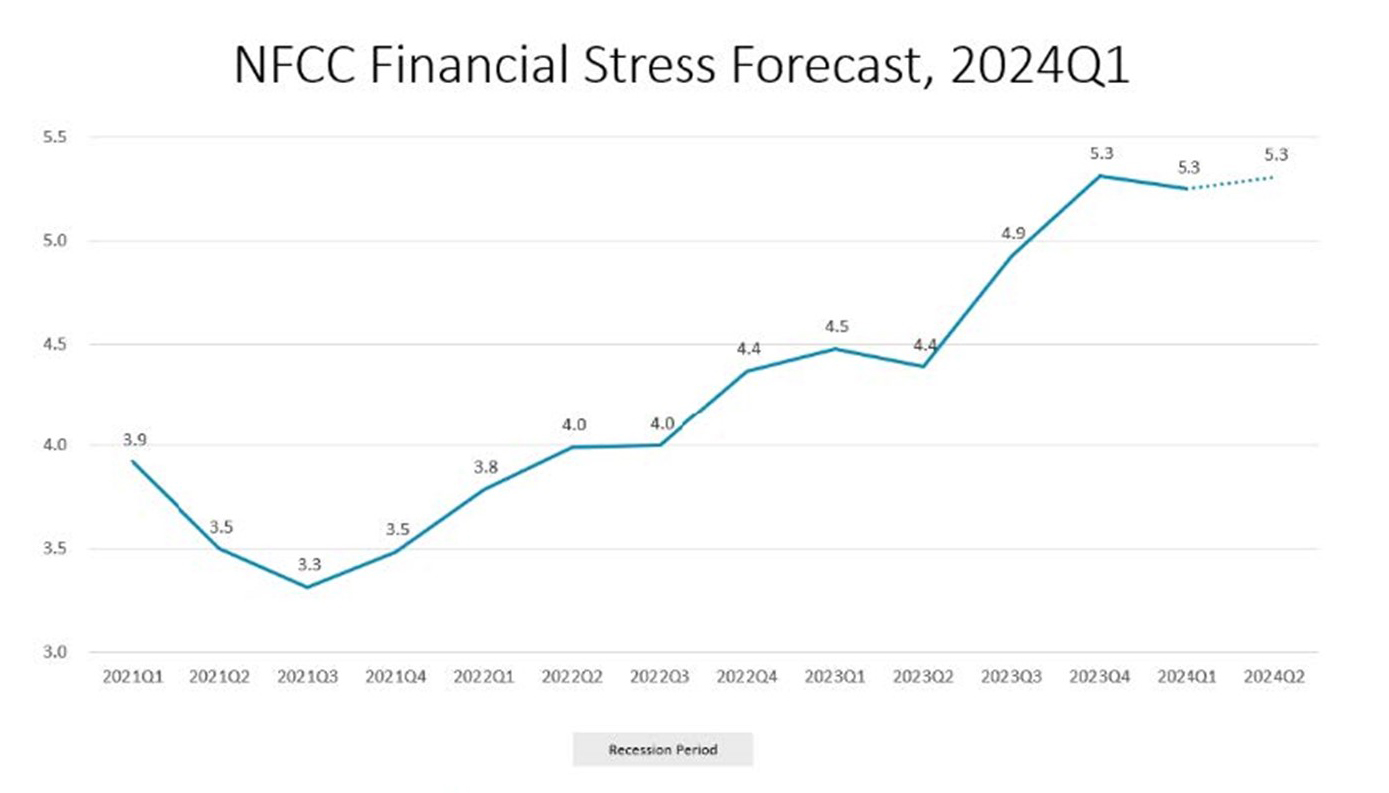

The NFCC Financial Stress ForecastSM is predicted to remain at 5.3 during the second quarter of 2024, holding steady as reported for the first quarter and up from 4.8 on a 10-point scale during the fourth quarter of 2023. This marks the highest the score has been since the first quarter of 2021, the earliest time tracked by the forecast.

The forecast indicates that people will continue to feel the same level of financial insecurity through the end of June as was the case in the first quarter of 2024. It remains noteworthy that the score has increased 49.9% from a low of 3.2 set in the second quarter of 2021, marking a sharp increase in consumer financial distress in a relatively short period of time.

“The persistent influence of high inflation and record levels of debt are leaving many to feel unable to take control of their finances. The sluggish pace of economic recovery leaves struggling consumers to rely on open lines of credit as a lifeline to make ends meet,” said Mike Croxson, CEO of the NFCC. “For those who have exhausted their borrowing power to stay afloat, time is not their friend.”

The NFCC Financial Stress ForecastSM offers valuable insights into U.S. consumers’ ability to repay unsecured debt, such as credit cards, and highlights the critical connection between consumers’ financial well-being, unsecured debt default and its ripple effect on the overall economy. Perhaps most importantly, it can predict the economic sentiment of consumers in the next quarter, barring any government stimulus or other intervening action.

The forecast is calculated through a proprietary algorithm which incorporates millions of data points from NFCC members as well as quarterly bank lending data reported by the Federal Reserve on total consumer loans, net charge-offs, charge off rates, delinquencies and delinquency rates.

“It’s more important than ever for people to pay close attention to their budget and how they are spending,” Croxson said. “For those who find themselves increasingly relying on debt to maintain a budget, there’s absolutely nothing wrong with seeking help before things become worse.”

The development of the NFCC Financial Stress ForecastSM was funded by JP Morgan Chase.

About The NFCC

Founded in 1951, the National Foundation for Credit Counseling (NFCC) is the oldest nonprofit dedicated to improving people’s financial well-being. With 1,215 NFCC Certified Credit Counselors serving 50 states and all U.S. territories, NFCC nonprofit counselors are financial advocates, empowering millions of consumers to take charge of their finances through one-on-one financial reviews that address credit card debt, student loans, housing decisions, and overall money management. For expert guidance and advice, call (800) 388-2227 or visit www.nfcc.org.