Should I Consider the Public Service Loan Forgiveness Program (PSLF)?

The NFCC often receives readers questions asking us what they should do in their money situation. We pick some to share that others could be asking themselves and hope to help many in sharing these answers. This one is about the Public Service Loan Forgiveness Program.

I currently have FFELP loans, and have worked in public service for five and a half years, and want to discuss potentially consolidating to a Direct Loan to be eligible for Public Service Loan Forgiveness under the new Biden administration executive action.

The Public Service Loan Forgiveness Program (PSLF) has had less than a 2% approval rate since the program started in 2007. So, the Biden administration has implemented a waiver to expand and relax qualifying criteria for borrowers through the Department of Education. They have called this program the “Limited PSLF Waiver.” The program overhaul aims to help many borrowers who may have otherwise not qualified get the opportunity to have their loans forgiven if they submit their PSLF application by October 31, 2022.

Qualifying criteria for the Limited PSLF Waiver

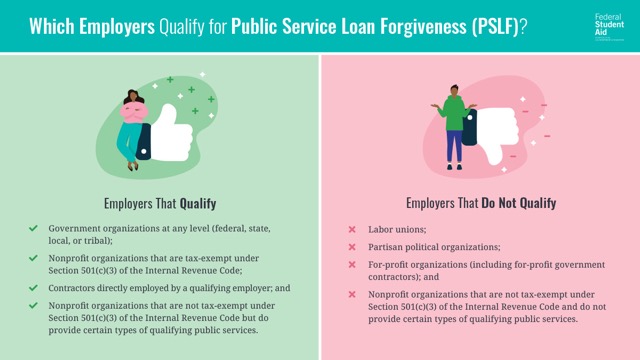

To qualify for the program, you need to have the correct type of loan, a direct loan, and work for the right employer. In your case, you would need to consolidate your Federal Family Education Loan Program (FFELP) loans through a Direct Consolidation Loan. Then you need to verify that you have worked for an eligible employer for the past five and half years to get credit for those payments. One of the easiest ways to certify your employment eligibility is to use the Department of Education PSLF Help Tool. Through this tool, you can get details about your eligibility, print the employer certification form, and find out the number of payments that will be credited toward the 120 payments needed to satisfy the PSLF payment requirements.

Determining if PSLF is right for you

It’s crucial to understand the pros and cons of consolidating your loans to apply for PSLF. As you further consider this possibility, think about your overall financial picture, your actual forgiveness eligibility, and if you plan to continue working with the same verified employer. The main benefit of consolidating your loans to Direct Loans is that you will be eligible to qualify for PSLF and other federal programs that can help you with your payments. In addition, you could also qualify for COVID-19 relief measures such as the suspension of loan payments and 0% interest until August 31, 2022. On the downside, you may lose some benefits such as interest rates discounts associated with your current loan.

Where to find help

Your loan servicer should be able to provide you with current and accurate information about your eligibility. However, it is understandable to mistrust some servicers due to their track record of providing incorrect or misleading information. In this case, it pays to be informed. To get information, use the US Department of Education PSLF webpage or call the current loan servicer handling the program, FedLoan Servicing, at 1-855-265-4038. You can also rely on the help of a certified NFCC student loan counselor to help you review your options. You can reach counselors online or by calling 1-800-388-2227. You still have some time to think it over.