Financial Stress Forecast

Financial Stress

Among Consumers

Financial stress, a pervasive issue affecting many individuals, can lead to anxiety, depression, and even physical health problems. The Financial Stress Forecast and Debt Burden Scale are invaluable tools for understanding the extent of this problem and predicting potential economic downturns. By providing insights into Americans’ financial behaviors and attitudes, these metrics enable policymakers, financial institutions, and individuals to take proactive measures to mitigate financial hardship and promote overall economic stability.

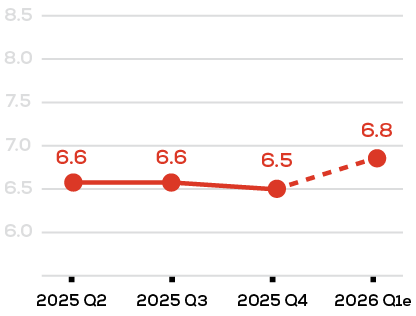

The Current Forecast

According to NFCC data, an increasing number of counseled consumers struggle to stay afloat, indicating that a growing segment of the population is not just overextended — they are technically insolvent. They have income, but no remaining disposable cash flow to fund a more affordably structured repayment plan after covering basic necessities.

“The Fed’s data tells us who missed a payment yesterday; our forecast of 6.8 tells us who is going to hit the wall tomorrow,” said Mike Croxson, CEO of the NFCC. “We are seeing a disturbing shift from discretionary debt to survival debt. When the financial buffer runs out, the climb in stress isn’t gradual. It’s vertical.”

Key Insights from the Q1 Forecast:

- The Plateau is the Problem: The FSF has held at 6.6 for three consecutive quarters. In a healthy recovery, this number should be retreating. Its persistence suggests that high financial stress has become the new normal for middle-income households.

- The Functional Tightening of Credit: While credit limits continue to rise for prime borrowers, our data indicates a functional tightening for those on the margins. High interest rates and inflation have raised the barrier to entry so high that distressed borrowers are being priced out of the lifelines they need most.

- The Invisible Distress: Traditional credit reporting models are failing to capture the full picture because consumers are prioritizing credit card payments over other obligations to maintain liquidity, masking their true financial fragility until the moment of default.

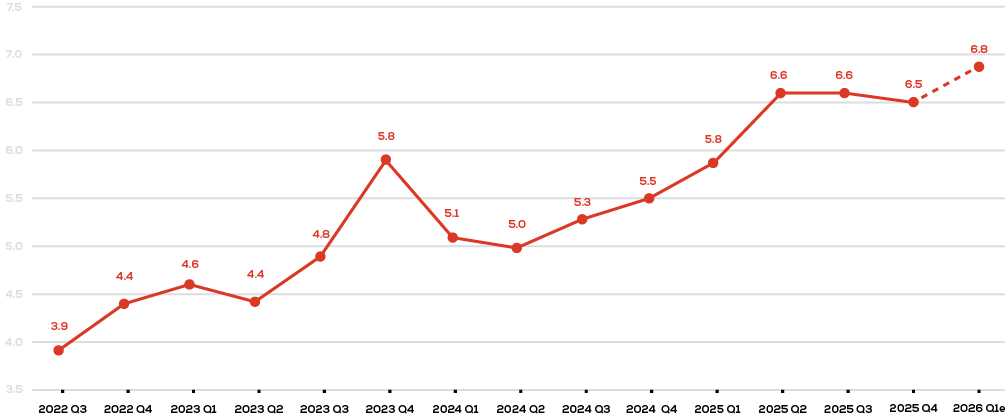

The Forecast History

How it works.

The NFCC Financial Stress Forecast can predict delinquency rates among consumers with credit card debt.

It gives insight on the federal reserve delinquency and charge off rates for the upcoming quarter with 95% accuracy.

The NFCC Financial Stress Forecast serves as a critical early warning indicator of potential economic instability.

National Foundation

for Credit Counseling

Founded in 1951, the National Foundation for Credit Counseling is the oldest nonprofit dedicated to improving people’s financial well-being. With 1,215 NFCC Certified Credit Counselors serving 50 states and all U.S. territories, NFCC nonprofit counselors are financial advocates, empowering millions of consumers to take charge of their finances through one-on-one financial reviews that address credit card debt, student loans, housing decisions, and overall money management.