2025 Financial Capability Survey

New Data on Stress, Debt, and the Military Community

The 2025 Financial Literacy and Preparedness Survey, conducted by The Harris Poll with support from Wells Fargo, reveals a complex and challenging financial landscape for Americans. From persistent economic worries to unique debt pressures on military households, the data confirms a broad need for proactive financial guidance.

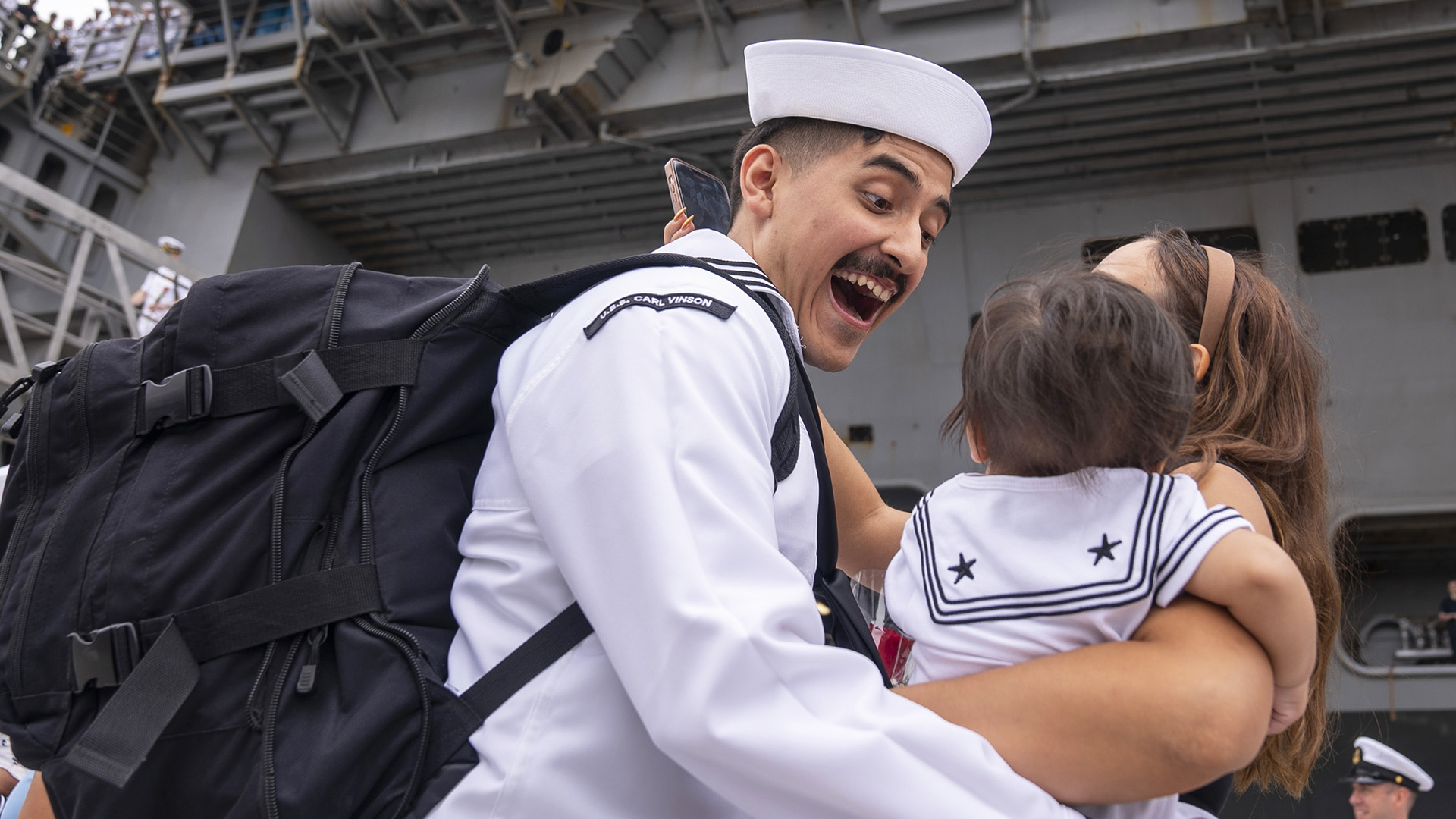

Active Duty Service Members & Spouses: High-Risk Households

Military households face heightened and unique financial challenges driven by the nature of service, including high relocation rates and employment gaps for spouses.

- Survival Mode: Half (50%) of Active Duty Service Members report being “just getting by financially,” a significantly higher proportion than the General Population.

- Acute Income Anxiety: This strain is reflected in worry: 55% of Service Members and 51% of Military Spouses are “very worried about potential loss of income and job security.”

- Reliance on Risky Debt: Active-duty households show higher usage of high-cost debt: 19% of Service Members and 16% of Spouses have ever used a payday or cash advance loan, more than double the rate of the General Population (9%).

- Seeking Expert Help: Reflecting a strong recognition of risk, Service Members (16%) and Spouses (19%) are dramatically more likely than the General Population (5% – approximately 12.9 million people) to say they would turn to a professional non-profit credit counseling agency first for help with debt problems.

Veterans: Financial Transition Gaps

For those who have left the service, the financial difficulties often shift from active-duty stress to challenges navigating the civilian world and accessing appropriate resources.

- Difficult Transition: More than one-quarter (26%) of Veterans found it “difficult to adjust to managing my money as a veteran as opposed to an active duty service member.”

- Resource Gap: A significant 42% of Veterans “wish I had more information about financial resources specifically for veterans.” This highlights a clear need for better targeted financial education and counseling to support the transition to civilian life.

- Debt Habits Persist: 13% of Veterans have ever used a payday or cash advance loan, a rate higher than the General Population.

The 2025 Financial Literacy and Preparedness Survey was conducted by The Harris Poll on behalf of the NFCC with support from Wells Fargo.

The Harris Poll

Founded in 1956, The Harris Poll is one of the longest running surveys in the U.S. tracking public opinion, motivations, and social sentiments. Every year, we poll millions of people on the trends that are shaping our modern world.

Funding provided by