Almost 2/3 of people don’t know how much they spent last month. Do you?

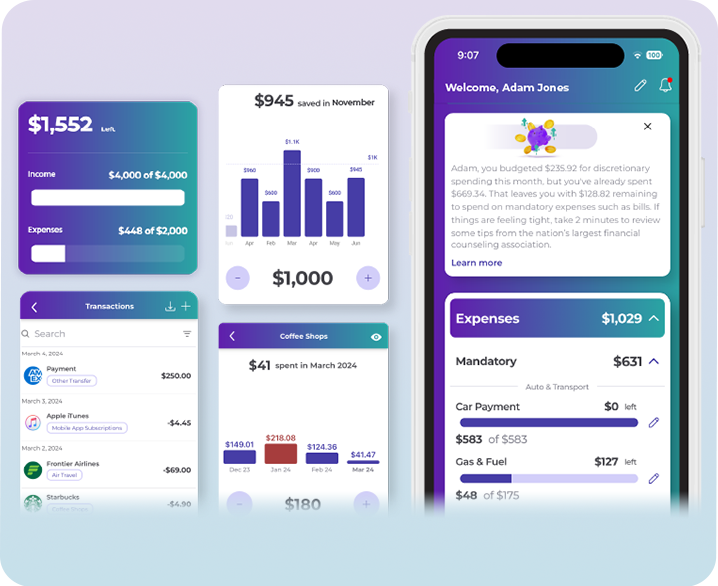

To better understand your financial situation prior to engaging with an expert such as an NFCC-certified nonprofit credit counselor, take advantage of Piere to see how counseling could help. Get Piere’s financial intelligence, personalized budgeting with debt insights, and a growing list of features for iPhone or Android today.

* [source: Turbo Tax/Mint]

How Credit Counseling works.

NFCC-certified credit counselors are ready to help you with a personalized action plan and resources regardless of your income or financial status.

-

Connect with an NFCC-certified credit counselor for a confidential consultation

-

Participate in a one-on-one review of your financial goals and budget

-

Create a personalized financial action plan

About the NFCC

Founded in 1951, the National Foundation for Credit Counseling is the oldest nonprofit dedicated to improving people’s financial well-being. With over 1,200 NFCC Certified Credit Counselors serving all 50 states and U.S. territories, NFCC nonprofit counselors are financial advocates, empowering millions of consumers to take charge of their finances through one-on-one financial reviews that address credit card debt, student loans, housing decisions, and overall money management.